The new millennium sees Transfield exiting from its historic core activity and subsequently carving out new markets.

Page Media:

The new millennium sees Transfield exiting from its historic core activity and subsequently carving out new markets.

Page Media:

After successfully listing Transfield Services in May 2001, Transfield Holdings' main active business remained construction. However, a decision was made some 12 months earlier that the construction business required the injection of new capital.

To this end, ABN-Amro were engaged as advisers to source a Joint Venture partner for the whole business. The advice virtually from the outset was that the business needed to improve its profitability and its order book to attract any interested party.

For over a year the company and its consultants looked for a prospective joint venture partner, internationally and locally. At the time, it seemed that the whole sector was flat, as few construction companies were trading well in what was hitherto a risky and litigious environment. The initial hopes of finding a partner to share the risk proved fruitless.

Video: Sydney Rail Link

As part of the drive to rationalise operations, steel fabrication at the Seven Hills workshop was discontinued in September 2000 when an announcement was made to also sell the property. There was simply not enough work in NSW to feed what had become the biggest integrated fabrication facility in the country. Zincline, Transfield's galvanising business, was sold separately, and so was later its Corrosion Protection and Reinforced Plastics (RPC) Division.

Page Media:

By the end of 2002, it was plain that little interest was forthcoming to join forces in Transfield Construction. Other contractors may have been interested in growing their presence in Australia, but most were not prepared to take over the current liabilities of the company, including the substantial level of performance bonding.

Up until this time, Guido and Luca were only considering a 50% divestment, not a total sale. However at the same time, they had decided not to continue to independently fund what had proven to be, for them, a very volatile investment. The catalyst for the sale came when Leighton's were approached for the 50%, but quickly responded in saying that they would be only interested in the whole business.

Page Media:

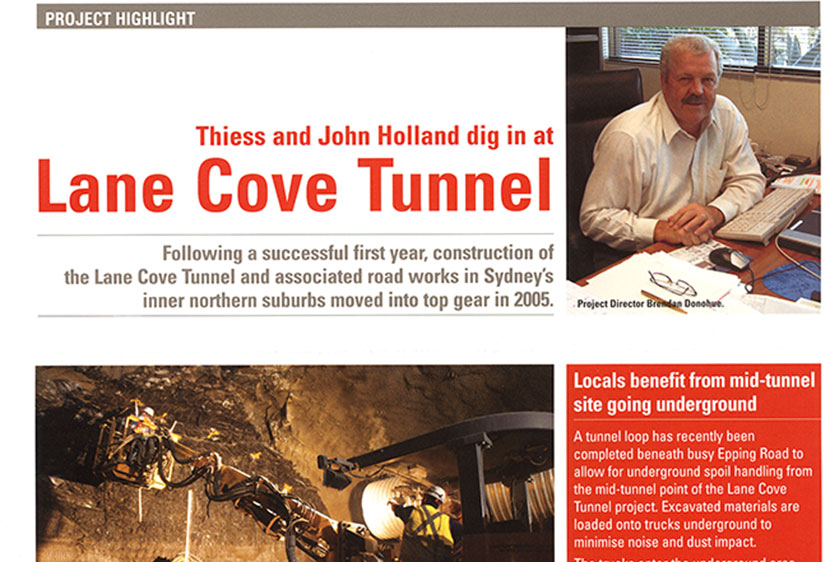

Wal King, the CEO of the Leighton Group, nominated John Holland, a subsidiary, to explore the opportunity. John Holland's CEO Bill Wilde led the negotiating team. The deal was quickly clenched and, on 5 December 2002, Guido announced that John Holland had acquired the assets, contracts, property, plant and equipment of Transfield's construction business. The sale included the transfer to John Holland of approximately $500 million of work in hand, including Transfield's equity and D&C stake in the consortium that eventually won the $1.1 billion Lane Cove motorway in Sydney.

Page Media:

All of Transfield's construction employees (approx. 800) were offered employment with John Holland, with virtually all transferring with all their entitlements preserved. The sale of Transfield Construction marked the end of an era for many, but for no one more so than Franco Belgiorno-Nettis, who had persevered to the end with the joint venture option.

Page Media:

Having shed its construction unit, Transfield Holdings now comprising a key group of personnel, about 35 in total, was free of debt, cashed up ready to embark on a new future. The company's interests still ranged across a diverse portfolio of businesses: infrastructure, with its part ownership of the Sydney Harbour Tunnel, Airtrain and AirportLink Co; services, through its listed vehicle Transfield Services Ltd.; defence, through ADI, and property, with its joint venture at Walsh Bay and in Perisher Blue, Australia's biggest ski resort.

Page Media:

Despite the upheaval caused by the company's realignment, Transfield's bill of health was reassuringly positive. The first years of trading for Transfield Services in the public arena were very pleasing, registering more than 30% growth per annum in profitability and share price.

Video: Brisbane Airport Rail Link.

However, Transfield Holdings actively sought to position itself in new businesses. Its first foray was in the property sector, given its experience and capability. In June 2004, Transfield Holdings acquired a half stake in Charter Hall, a company that had achieved a solid track record in property funds management, property investment banking, development and property management. Within one year, CharterHall listed on the ASX, with Transfield retaining a major shareholding.

Page Media:

Soon after, Transfield Holdings acquired a stake in Campus Living, an enterprise specialising in student accommodation. Campus Living was managing a 650-bed student housing facility for the University of Sydney. By 2006, Transfield Holdings had become the sole shareholder and grown the business to some 6000 beds in the pipeline in Australia and New Zealand. In the same year, the company acquired 100% of Century Campus Housing, the largest US on-campus provider of accommodation with almost 20,000 beds under management, employing some 650 personnel and turning over US$40 million.

Page Media:

By 2006, Transfield Holdings had reasserted itself by successfully listing Transfield Services and CharterHall, by diversifying into social infrastructure with Campus Living and by acquiring a strategic stake in Australian Biodiesel Group.

One of the key aspects that differentiated the new Transfield from the old, was the adoption of a collegiate style of management. This approach favoured active discussion, more in keeping with the expectations of modern executives. The new Transfield Holdings became a unique place to work in, a business where senior executives participated fully in decision-making, challenged and motivated by responsibilities in the outcomes that they often determined.

By 2006, the fiftieth anniversary of the establishment of Transfield Holdings, the company had re-invented its business, rekindling market confidence and steering towards new and profitable directions.

Page Media:

Australian Paper Mills

Sydney Airport Link